So, you are a photographer and a company has asked you for a W-9. Don’t panic, it’s not a big deal at all. It’s mostly just for tax purposes on their end and it really shouldn’t change anything for you. The form is 3-4 pages, but really you only need to fill out the top half of page one. The first box is your Name and should be simple enough. If you don’t know what your Name is, I’m afraid I can’t help you.

Next is the Business Name. I am writing for those that have an LLC. like I do. If you have a corporation, partnership, or Trust, I can’t help you. So, on the Business line, simple enter the name of your registered LLC. In my case it would be Obviouschild Productions, LLC. DBA Pabst Photo, kind of long since I have two names in there, but most people would just have the one. This like should be fairly simple as well. The following box is where it gets every so slightly complicated.

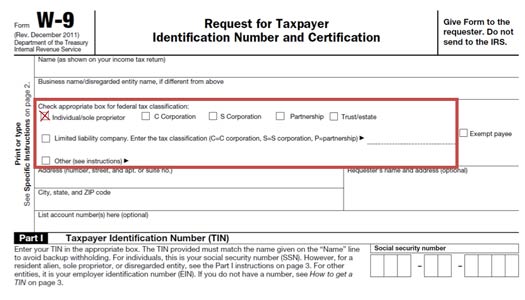

You need to “check the appropriate box for federal classification.” At first glance, I thought for sure I would check the Limited Liability Company because I have and operate under and LLC. After doing some research, I realized that I have the most basic kind of LLC – because I am just one person and don’t have employees or anything – as such, I am actually supposed to select “Individual/sole proprietor.”

- LLC S CORPORATION | How do you know what kind of LLC you have? Did you fill out IRS Form 2553 – the LLC’s tax status is S corporation if you did – then you would select LLC and S for S-corporation.

- LLC C CORPORATION | Did you fill out IRS Form 8832 – if so, you are LLC tax status C-Corporation – so you would check LLC and write in C to the right for C-Corporation.

What does that mean? Basically, many of us photographers start LLC so our business is official and legally separate from out personal income. However, most of us don’t do anything fancy for tax purposes. LLC-S LLC-C and LLC-P are more complicated forms of LLC in which you are filing out forms to elect your company to be taxed differently.

If you are like me and your LLC HAS ONE OWNER, then the LLC’s default tax status is a disregarded entity for tax purposes. This is basically any business that is considered separate from its owner for legal purposes but not for tax purposes. In other words, if your LLC does not specifically elect to be taxed as a corporation it will be taxed in the same way as a sole proprietorship. So to complete this portion of the W9, you would fill in your personal name in the NAME BLOCK, your company’s name in the BUSINESS NAME BLOCK, your company’s address in the address block, and check the box labeled : “Individual/sole proprietor.” And that is exactly what I did.

I should also add that if your LLC has two owners, then the LLC would be a partnership or P.

Additionally, you may not have an Employee Identification Number – if you want to use your LLC you should register for one. There’s no harm in using your personal SSN, but then you may not be legally protected by the LLC you registered for.

Remember, I am a photographer, not a tax guru, CPA, accountant ect… you should read the text on all the pages of the W-9 and if you feel it’s necessary you should contact or your CPA or attorney.