Do Wedding Photographers Charge Too Much?

I’ll let you decide. We are a wedding photographer here in Chicago, Pabst Photo, and we are going to take a look at some numbers behind the scenes.

Where does the Money go?

I keep a very tight record on expenses and accounts receivable. There are two good reasons to do this. One; it’s how you run a business. Two; it’s how you should run a business. I could look at any year, but since 2014 is coming to a close, let’s take a look at our expenses this year. I am going to break down the expenses into categories, the same way the IRS does.

A disclaimer; every business is unique and we are not suggesting we are representative of all wedding photographers. We only aim to illustrate some of the expenses and challenges that most wedding photographers face. In 2014, as a photography company, we spent:

Total = $19,000

$140 in Charitable Donations: These things might include donating to candidates, Goodwill, St. Baldrick’s Foundation, The Leukemia and Lymphoma Society, and NPR during any given year. That’s us, but could be just about anything you find worthy. Unfortunately, services such as photographing charitable events will not count as an expense against your income. I wish the IRS would change this rule.

$1062 in Food and Drink: This includes meals on event days, coffees on those mornings, and a handful of client dinners, meals, ordering food while editing ect…

$84 Office Supplies: This includes printer paper, blank DVD media, pens, ect…

$398 Stock Licensing: This is for ONE song on the Music Bed. Yes, I could download an MP3 and use it illegally, but we didn’t do that.

$4170 in Asset and Gears: I predict this number to go up further about $3,000 by end of year, as a new laptop is on the horizon and perhaps a 24-70 2.8 lens. On the docket this year were things like our $498 Lowepro Camera bag, our $1,790 Canon 6D, and more than $600 in lighting equipment. Upgrades in these amounts are standard about every year.

$3600 Advertising and Marketing: Includes things like Facebook adverts, Google Adwords, and something we’ll never do again, weddingwire. We don’t shoot 50 weddings a year and we haven’t been at this for 20 years, so we don’t book all of our work through referrals. Advertising is a necessary part of our current business plan.

$1364 Computer Related: This includes a $400 video card to run 4k, a $573 super HD 27″ color calibrated monitor. It also includes things like a webcam, a new power supply, Spyder, ect… Since these graphics were created, I dropped another $600 on a new Lenovo laptop. $1964

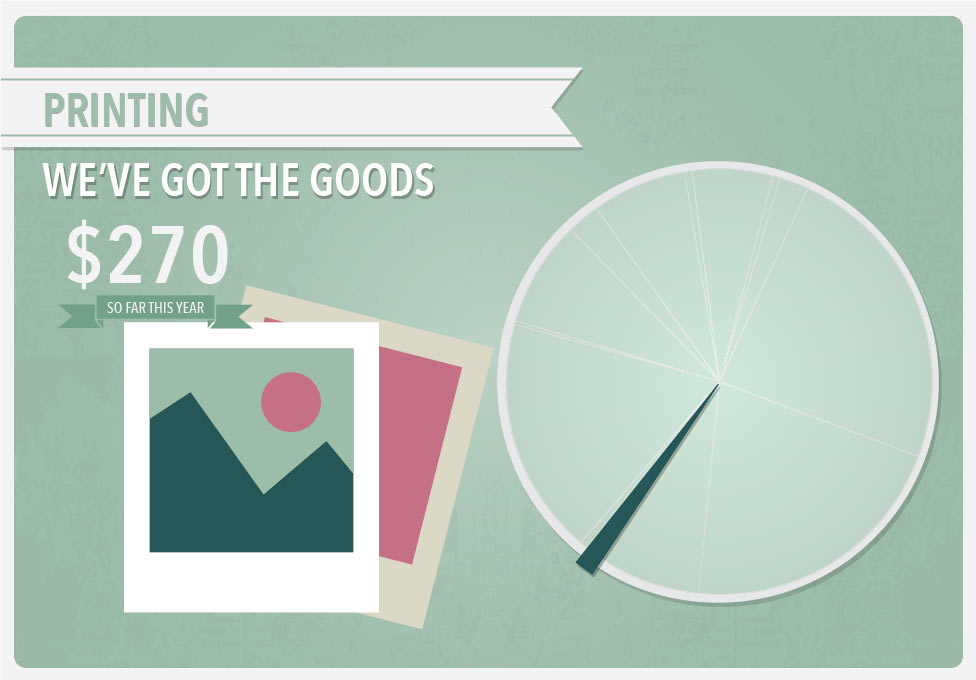

$270 Printing: This does not include the out of pocket costs of our albums; this is test printing – when we album shop. We always test services before we offer them to our clients.

$74 Soft Goods: These are silly, but things like work clothes. Black slacks ect… We didn’t purchase much in 2014, but next year this category could easily be $500.

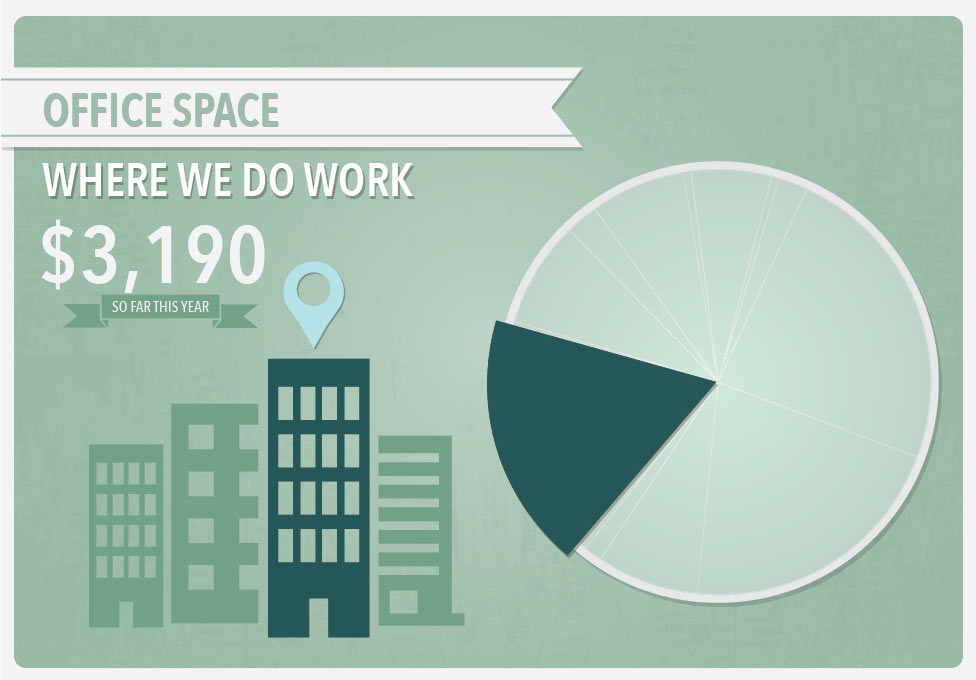

$3190 Portioned Rental Space: We have no choice but to have a two bedroom to do this work. We live in Chicago. We could save a lot of money like many of our friends by going to a one bedroom, but we need an office with two computers. As such, we expense about 225 square feet of that space.

$25 Shipping: This should be a lot higher. It tells me I forgot to record some expenses. Shame on me. Who said running a business was easy?

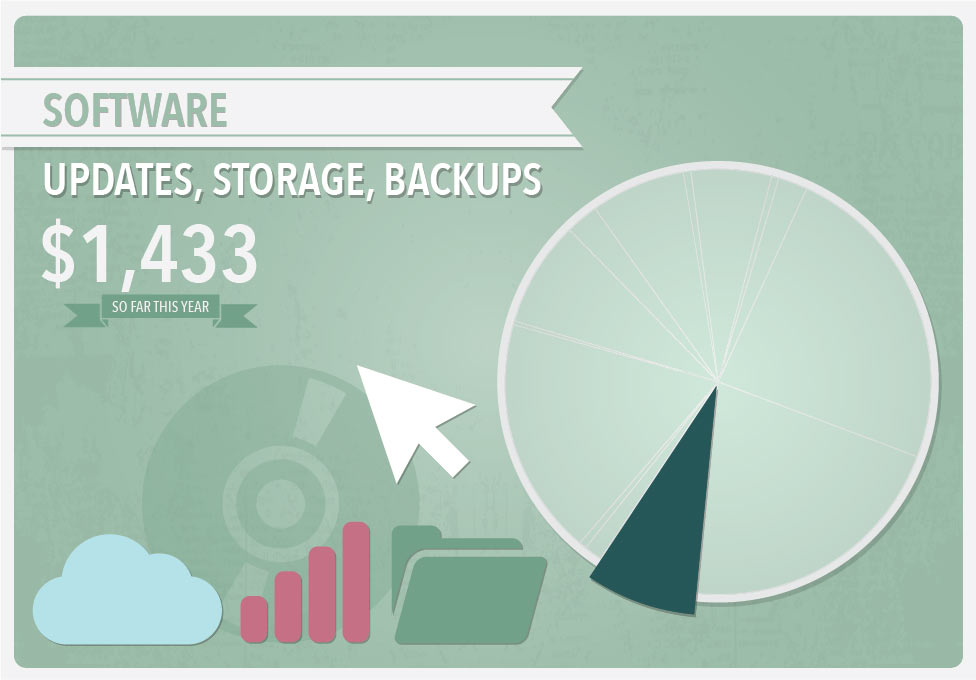

$1,433 Software – Online/Offline: This includes our accounting software, access to Adobe products, our website hosting, and cloud storage. Hosting GB of data, backing up clients pictures remotely – that is not cheap. It’s also something only a true professional photographer will do. In fact, we store over a terabyte of data on the cloud to protect investments. For the geeks, we use Bitcasa.

$455 Travel Expenses: This really is just gasoline. Getting to our shoots.

$1,244 Additional Utilities: We must have premium internet. The $19.99 DSL will not due for us. We have video conferences with our out of town clients. We also need to push hundreds of GB to the cloud in a timely fashion.

The total for the year; well over $19,000

according to my accounting software (not all expenses listed). There are additional expenses I did not include, like our $400 insurance, parking fees, and taxis to name a few. Now, could we cut some corners? Yes, but that’s not our brand. Pabst Photo is dedicated to offering a superior product and experience. We want to give our clients what they would expect from a luxury brand. It’s a choice. I reiterate – this is not meant to represent all wedding photographers.

Now, I know most people aren’t into math, but really quickly, let’s say our average wedding photographer costs 3,000 neh, let’s be generous for our readers, $3500. Let’s say we shoot a wedding every other weekend the whole year – not going to happen, but let’s just say we do. That would be 26 weddings a year. So, 26 weddings (a lot) at $3,500 would be $91,000 minus about 30% for taxes (and self employment taxes) leaves $64,000 then subtract that estimated $19,000 in expenses on the year leaving $45,000.

Owning your own business is tough work no matter what the industry. Many people forget what you give up when you leave the corporate world. Things like health insurance and 401k programs are often taken for granted. Wedding photography is extremely competitive and a lot of people do it very poorly and for pennies. This often results in disappointed brides. Sad, but true. Every one of us knows someone who was terribly disappointed in their wedding photographer. We take our business of capturing weddings very seriously. It’s hard work and it only happens once. There is a big gap between the person who can get one or two good shots at a wedding and the professionals who can get hundreds of good shots. That is the difference. Any photographer with professional grade gear can take 2500 pictures and find some keepers. Though gear is important – you are paying for knowledge and skill.

There is a lot of trash talking in wedding photography circles right now about the inexperienced photographers ruining the industry. It’s not true. Keep producing quality work and your business will flourish.

Jamie and I love shooting weddings. It’s fun to work with your spouse. Not every day – but it is fun. We love getting letters and e-mails from ecstatic clients. We love seeing a photo get 100 ‘likes’ on Facebook and 30 flattering comments for the bride.

I’ll just state this for the record, if there’s still any doubt after this article, we don’t do it for the money.

Follow Josh and Jamie at Pabst Photo on Facebook.

NOTE: All graphic design done by my talented wife Jamie! If you’d like to borrow or feature the graphics, please let us know.

I think it’s more than raw number though. It’s also about the product. 20 years after the wedding the only tangible things left from your wedding day are the photos – the dress won’t fut, the food is long gone, technology may have changed making.rhe video obsolete, etc. But we’ll crafted, high quality photographs will still hang on the wall and be cherished in a professional album. I tell every bride that I consult with, whether they choose me or nit, to cut corners somewhere else in their planning but shell.out the cash for a great photographer. We are keepers of the memories!

You’re right Deb. Brides pay just as much for flowers. Doesn’t make a lot of sense does it?

Do you pay taxes before paying expenses ?

You’re right, they shouldn’t. Taxes are paid on income after expenses are deducted. Write off, write off, write off. Everything you legitimately can. If they’ve been paying taxes on their gross they’re either not too bright and/or need to fire their accountant/tax guy.

i am a photographer. it’s not my profession. it’s who i am. i don’t see scenery, people, or places. i see images….angles, framed shots and how to get them. through circumstances not important, i never finished my schooling, and my equipment disappeared. i have through the years, re-acquired a good camera, and a couple lenses. i have done many a wedding ( for a non professional), but only for people who cant afford someone with better equipment and experience. my advice to anyone who can,

GET A PROFESSIONAL

but MAKE SURE YOU SEE A PORTFOLIO and try to find someone who’s personality will compliment the day, not drag it down or clash with some or all of the people. try to find a GOOD FIT !!!!! yes there are many amateurs, who think a good camera makes a good photographer. NEVER HAS NEVER WILL. i do it because i love it . i don’t make money, but i do break even. but i have to add,

wedding photography is the most stressful job, but also the most rewarding, if done RIGHT.

even when i’m not taking official images, i’m constantly on the move, looking everywhere, for that candid that will make the couple know they made the right choice in me. Candids are often more shared and loved then even the most amazing, perfect posed images.

i go from pre-wedding preparations through the reception and dance. Therefore i am totally exhausted …mentally, and physically! and because i do this for friends, they always want me to hang around and enjoy festivities after the camera is put away. ….never happens . i would love to but its more exhausting to be the photographer than the bride!

A GOOD PHOTOGRAPHER DESERVES EVERY CENT of what he charges!

and by good i mean not only the images, but your business practices, and character

it’s my opinion that unscrupulous and 2nd rate photographers do more damage to the industry than the wanna be’s or uncles with a good camera could EVER DO……I am somewhere in between, but i NEVER misrepresent myself or my abilities, and the weddings i shoot would have only ‘UNCLE JOE’ if it weren’t for me.

but the old adage is true….most of the time…….YOU GET WHAT YOU PAY FOR.

the cake, decorations, flowers, and glitter all disappear…..a good photograph lasts a lifetime and beyond.

Deducting 30% for taxes is ridiculous, since everybody pays it. The only amount that would be relevant is the additional amount that you pay for being self-employed. And how many hours work do you have to do for one shoot?

Good point Mary. Generically – there is only an additional 7.5% for self employment – plus some other spots depending on state.

Incorporate once and say goodbye to SE taxes forever.

Corporations pay tax on their income and then he’d have to pay tax on the money paid to him from the corporation. It’s called double taxation

Good article, you did forget one important thing though. As a full time working professional you have to pay your own health insurance in full at about $19,000. Even if you work retail full time your job will pay $13,000 that you won’t see come out of your paycheck.

Craig; you make an excellent point.

I think this article is dead on accurate…

But you miss one very important thing…

MOST wedding photographers (or at least 90% of the ones I know) don’t only shoot weddings. If they are good, they shoot weddings almost every weekend, and most of the time on sat AND sun…not to mention the grad sessions, infant photos, maternity photos, family shoots, engagement shoots, and just your typical photo shoot for the family frames.

I just paid $3000 for my wedding photos by an amazing photographer. And she gave us our free engagement session. She shoots every weekend and throughout the week.

I would say, if you’re not shooting but once every other week, you need better advertising, better product, or more motivation.

Not trying to bash in any way, I’m just saying, if you are going to charge around $3000 like my photographer…you better be good…and if you are…you need to be shooting more.

Her annual income for the last 2 years was around $230,000 a year. Yah, blew my mind…but she try’s and puts herself out there. After taxes and fees, expenses and fun, she saves about $130,000 a year.

Again, not trying to bring Ya down! Just trying to encourage you to bring your game up. Work more, make more, live nice!

Tyler, thanks for commenting. My wife and I both have full time jobs on top of our photography business. I am an architect and she is a graphic designer.

Work hard, play hard.

Nice article, I also appreciate Anita’s comment above. I charge on the low end of the spectrum, relatively speaking. It is either something you do for the love of the work, the emotion, the event or the couple…. or you sort of suck. Doing it for the money alone probably is not enough of a motivator. I love shooting weddings but it is physically, and at times emotionally, draining. I love my clients though and would have it no other way.

Wait, shouldn’t you subtract relevant expenses before taking out that 30% tax? That’s some delicious tax-deductible goodness.

Thanks so much for sharing this! If only everyone could see the amount of time, dedication, knowledge, experience, passion and love that goes into photographing/filming a wedding they would know how much would know how much of a deal they are getting. Running a business is hard work, but the payoffs are worth it. Keep doing what you love!